Global nav (above) and landing page (below).

S&P 500 Direct

Global GTM (strategy, web, email, social, paid)

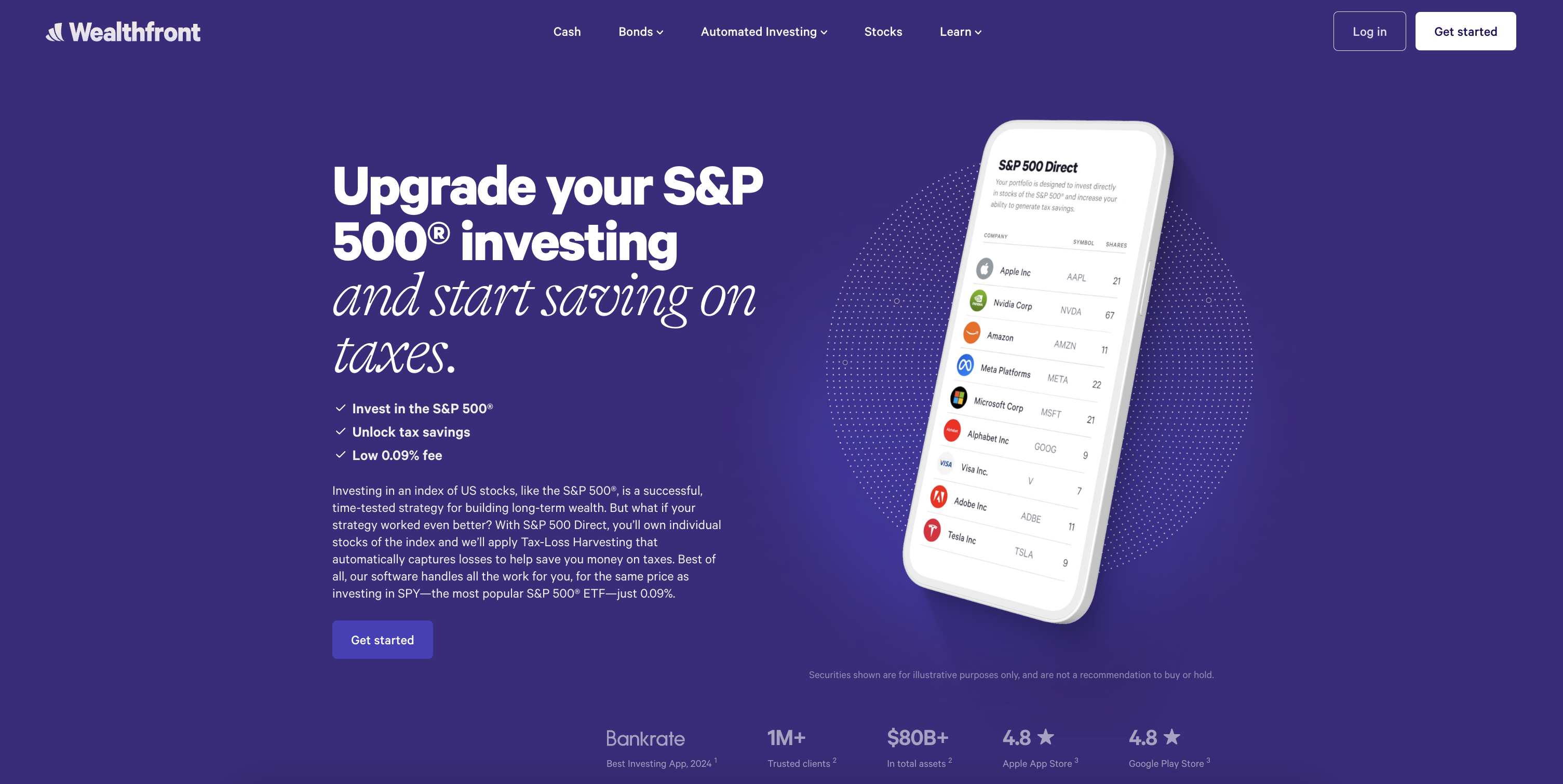

The good news: When your investments increase in value, you make money. The bad news: You’ll owe more than you want to pay in taxes. Lucky you. That’s where the S&P 500 Direct, a new portfolio from Wealthfront, solves a niche problem. You can invest in the stocks of the S&P 500 and prioritize tax-loss harvesting to offset current or future capital gains. Of course this may sound confusing or complicated, but thanks to Wealthfront’s automation, the experience is effortless.

New products require a desperate audience in order to work. So who is desperate for an automated direct indexing portfolio? A few words are working harder than others. By emphasizing the “upgrade” the portfolio likes an improvement on already common investing strategy. And by turning “save money on taxes” into a refrain, the key differentiator can help tie the twin benefits together.

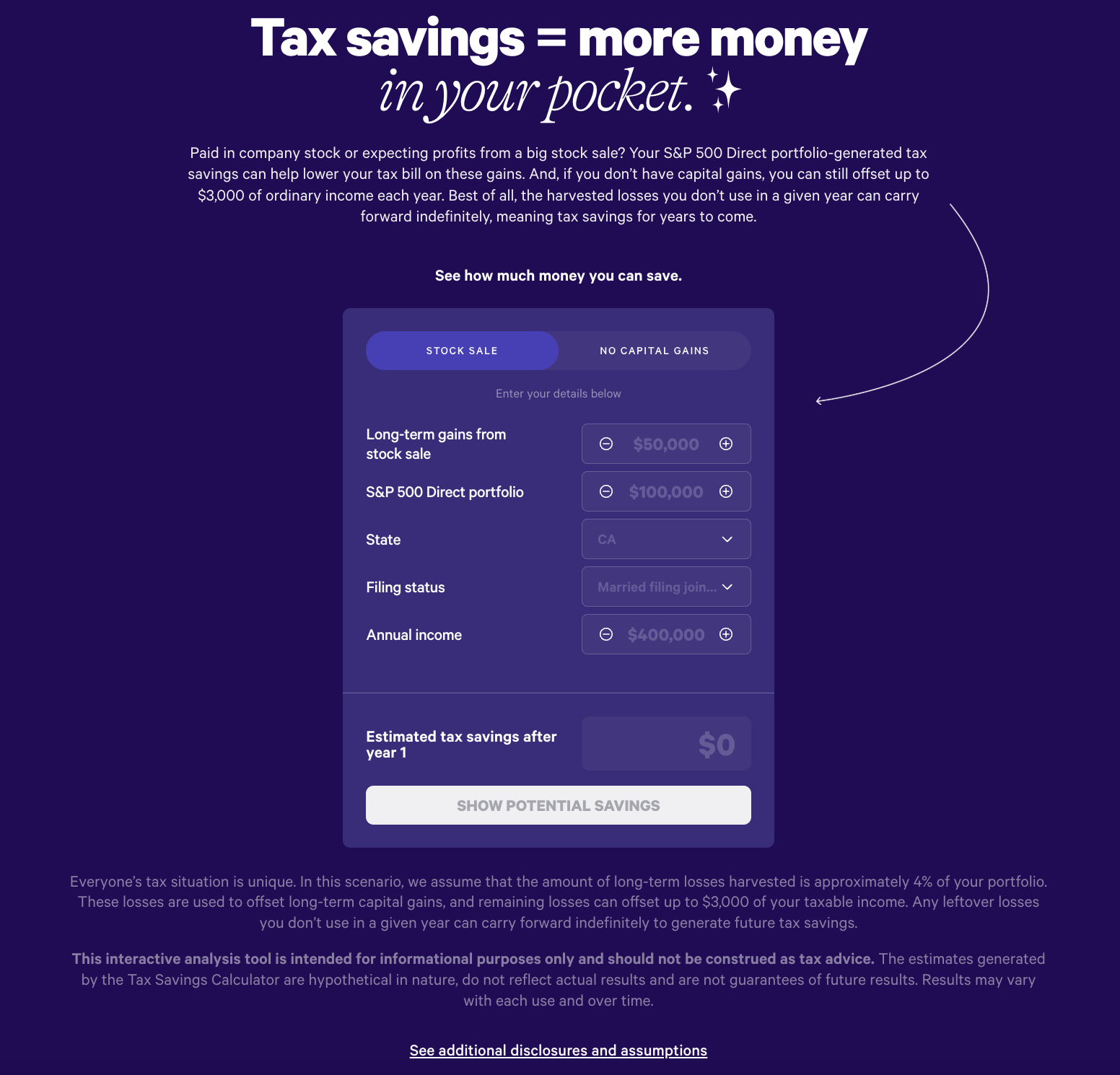

Not investment advice!

Of course there is still a lot to consider. And math is more convincing when it’s solved. The tax calculator helps break down something abstract and potential into something real and transferable. With $x invested there could be $y in taxes saved that can offset $z in capital gains. The proof is in the pudding.

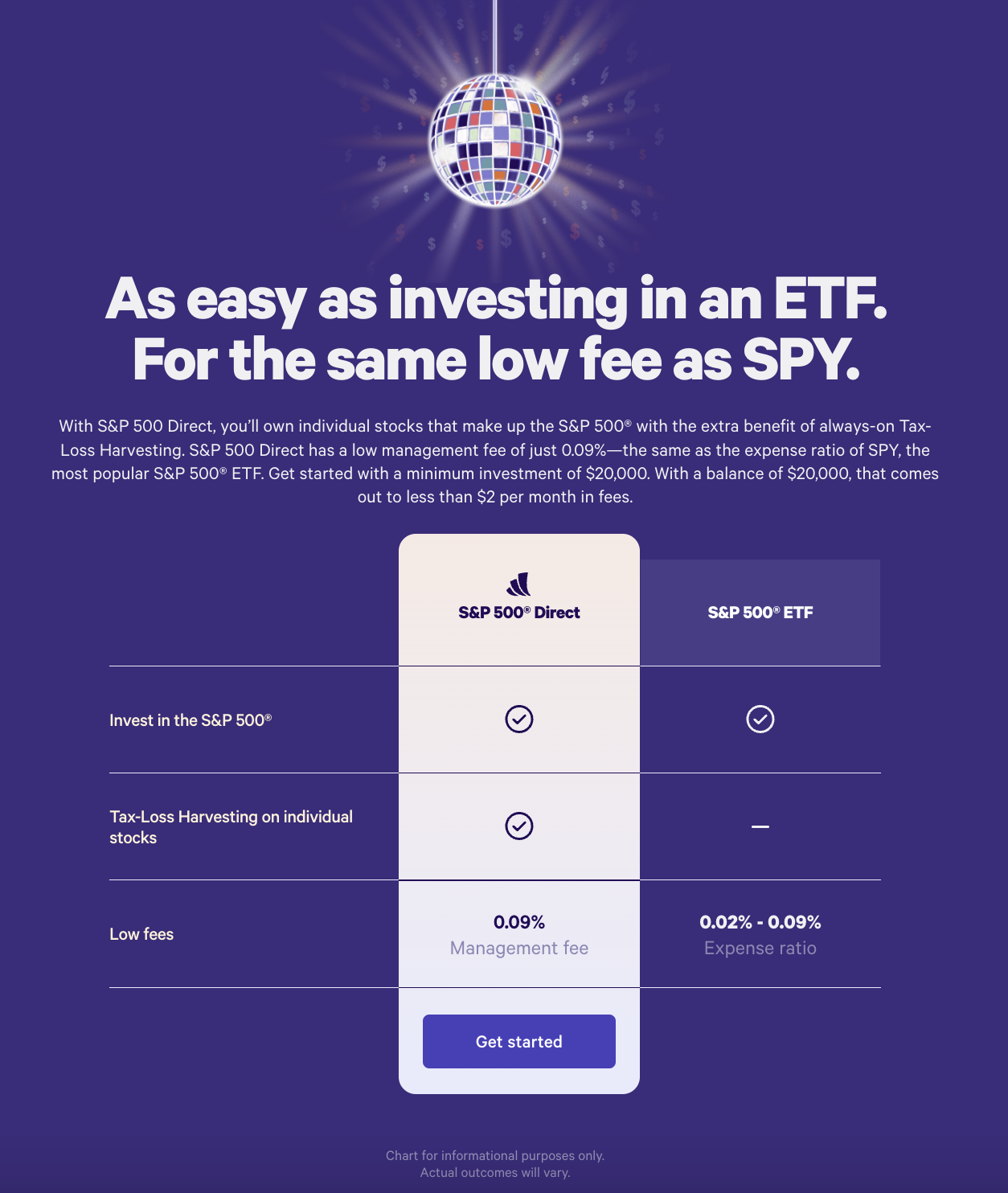

A comparison module and an FAQ section anchor the page to provide additional context on pricing and other benefits.